Zensar emerges frontrunner to buy Mastek in $900mn deal

BENGALURU: Zensar Technologies is said to be close to acquiring Mastek in an $850–$900 million stock-and-cash deal. The move bolsters the ongoing trend of consolidation in the IT/ITeS services sector, driven partly by the dramatic changes ushered in by AI and global customers looking to reduce their number of vendors.The past year saw multiple acquisitions, including Capgemini’s takeover of WNS, Wipro’s acquisition of Harman’s digital transformation solutions business, Coforge’s acquisition of Encora, and TCS’s buyout of Salesforce consultancies ListEngage and Coastal Cloud. The negotiations between Pune-based Zensar and Mumbai-based Mastek are nearing the finish line, sources told TOI. The combined entity will be a stronger mid-market challenger, with an expanded AI and digital engineering portfolio, greater geographic reach, and a wider base of clients.

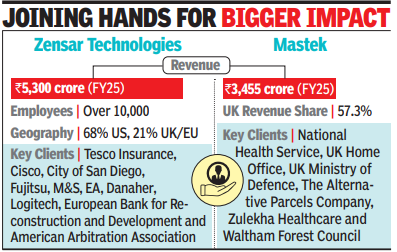

Joining hands for bigger impact

If completed, the joint entity will have revenues exceeding $1.3 billion. When TOI contacted Zensar, the company said it does not comment on market rumours and speculation. A Mastek spokesperson said, “We would like to state that the information shared is speculative and incorrect. As a listed company, Mastek adheres to strict disclosure norms and regulatory requirements. Any material development—strategic, financial, or otherwise—is disclosed accordingly.”The deal comes seven years after L&T’s unsolicited bid to acquire 66% in Mindtree for up to Rs 10,700 crore, highlighting renewed consolidation among technology services firms seeking scale and differentiated capabilities.Zensar, whose key clients include Cisco, the City of San Diego, and Tesco Insurance, derives nearly 68% of its business from the US and 21% from the UK/EU. The company reported revenue of roughly Rs 5,300 crore in FY25 and employs over 10,000 people. Mastek, which clocked Rs 3,455 crore in FY25, earns 57.3% of revenue from the UK and counts NHS, The Alternative Parcels Company, and Bank of England as key customers.It is positioning itself for the next growth phase by focusing on regional strongholds, particularly UK govt contracts, while rebuilding its US and AMEA operations. The UK–Europe market, contributing about 64% of revenue, is expected to deliver mid-teen growth, driven by rising digital healthcare investments.Healthcare emerged as Mastek’s fastest-growing vertical, backed by a strong track record in public-sector projects. The company is also expanding its Secured Govt Services presence and widening its footprint across departments such as the Home Office, HMRC, and the Ministry of Defence.